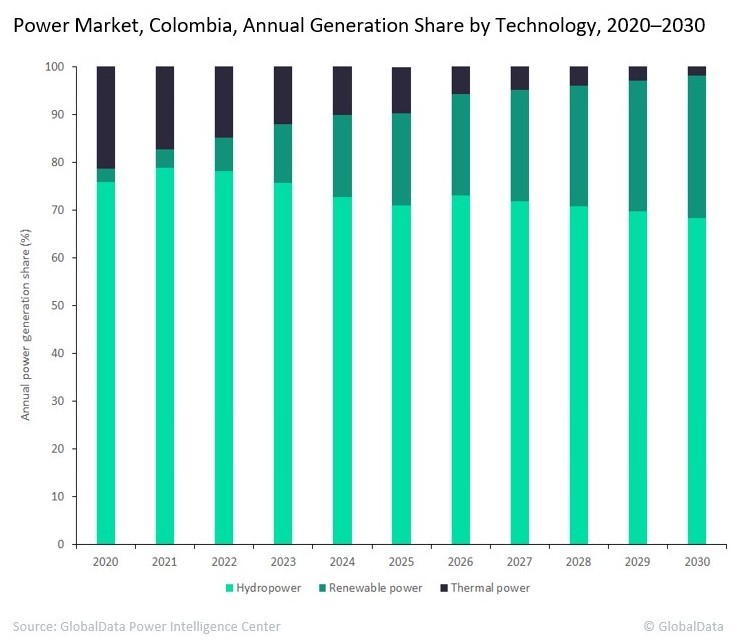

Thermal power generation share to become negligible in Colombia in 2030

.In Colombia, thermal power generation held a share of 21.4% in total annual generation in 2020, according to GlobalData's latest report. This share is expected to drop to 1.9% in 2030. Hydropower is the dominant source of power generation in the country. In 2020, hydropower accounted for a share of 75.9% in the country’s generation mix. During 2021–2030, the country plans to maintain the dominance of hydropower but at the same time gradually shift from thermal power generation to renewable power generation.

Hydropower will continue to dominate annual power generation in Colombia till 2030. However, hydropower generation in the country has become increasingly vulnerable to weather variability, specifically the hot and dry conditions associated with the El Nino effect. As the country does not have nuclear power, it plans to increase the share of renewable sources in its generation mix to reduce its dependence on hydropower. The country is situated in the equatorial zone, making it rich in renewable power sources.

Colombia plans to use these renewable sources in its future electricity generation mix to create a resilient and secure power supply. The government has also mandated power distribution companies to procure at least 10% of the power they distribute from renewable sources, which is expected to further strengthen the renewable sector.

Renewable energy auctions have paved the way for the rapid development of the sector in Colombia. The auction mechanism, which started in 2019, has to date offered around 2.5GW of renewable capacity in the two rounds the government conducted. In June 2021, the government launched the third round of auctions in which more than 5GW of renewable power capacity is expected to be offered. With this, rapid deployment of solar PV and wind projects is expected in the country in the next two years.

Colombia is a party to the Paris Climate Agreement and as per its Nationally Determined Contribution following the agreement, the Colombian Government is planning to reduce greenhouse gas emissions by 51% in 2030 compared to the baseline scenario, and these renewable energy auctions will help the country achieve this target.

In Colombia, the first case of Covid-19 was detected in March 2020. To reduce the spread of the pandemic, the government implemented national lockdowns and travel restrictions and social distancing measures. Several sectors, including the power sector, were hit due to the Covid-19 pandemic. As non-essential services and commercial establishments remained closed due to the national lockdown, electricity consumption dropped significantly in 2020. The electricity consumption decreased by 6.5% in 2020 as compared to 2019.

Moreover, several transmission infrastructure expansion projects of major utilities including Grupo Energia Bogota and Celsia Colombia witnessed delays.

The Covid-19 pandemic also impacted the hydropower projects under construction in the country. In June 2020, Empresas Públicas de Medellín, one of the major utilities in the country, announced that its Hidroituango hydropower plant with a capacity of 2.4GW is facing delays due to the Covid-19 pandemic and the construction is now expected to complete in 2022 instead of 2021.

GlobalData’s latest report discusses the power market structure of Colombia and provides historical and forecast numbers for capacity, generation and consumption up to 2030. Detailed analysis of the country’s power market regulatory structure, competitive landscape and a list of major power plants are provided.

The report also gives a snapshot of the power sector in the country on broad parameters of macroeconomics, supply security, generation infrastructure, transmission and distribution infrastructure, electricity import and export scenario, degree of competition, regulatory scenario and future potential. An analysis of the deals in the country’s power sector is also included in the report.

COMMENT