Feature

Exclusive: sodium batteries to disrupt energy storage market

With costs fast declining, sodium-ion batteries look set to dominate the future of long-duration energy storage, finds AI-based analysis that predicts technological breakthroughs based on global patent data. Oliver Gordon analyses.

Sodium-ion batteries’ rapid development could see long-duration energy storage (LDES) enter mainstream use as early as 2027. Credit: Fahroni / Shutterstock

Sodium-ion batteries are set to disrupt the LDES market within the next few years, according to new research – exclusively seen by Power Technology’s sister publication Energy Monitor – by GetFocus, an AI-based analysis platform that predicts technological breakthroughs based on global patent data. Sodium-ion batteries are not only improving at a faster rate than other LDES technologies but they are also set to be cost comparable with the cheapest forms of dispatchable power, and therefore enter mainstream use, as early as 2027.

The rapid improvement rate of sodium-ion batteries will likely lead to better energy density and reduce the cost per unit of stored energy, positioning them as a versatile option across the energy grid, even in large-scale operations.

Affordable LDES is a fundamental milestone for the global energy transition as it addresses the intermittency of renewable energy sources such as solar and wind, which do not produce electricity consistently. By storing excess energy generated during peak production times and releasing it during periods of low production or high demand, LDES systems ensure a stable and reliable energy supply – essential for reducing dependence on fossil fuels and enabling the widespread integration of renewable energy into the power grid.

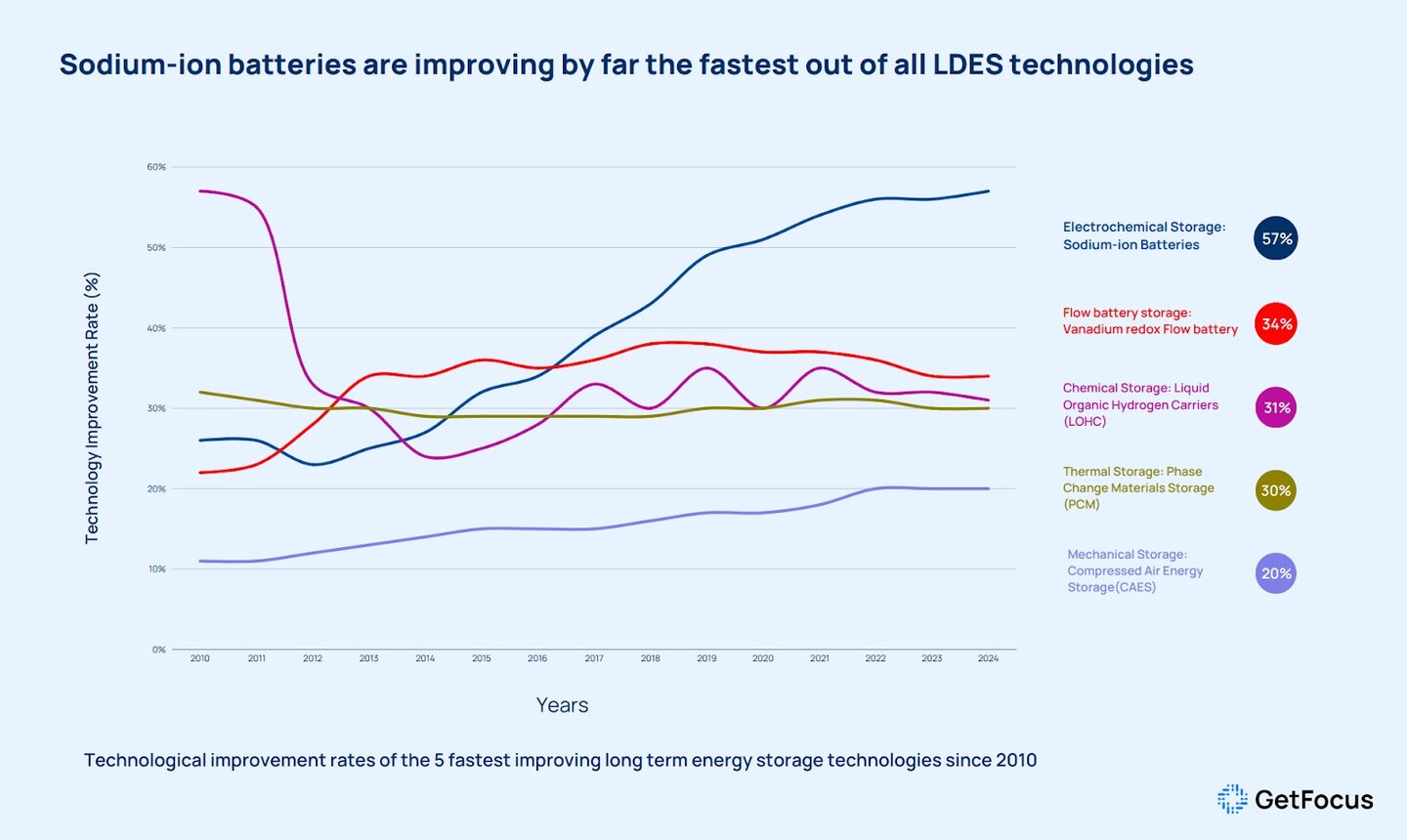

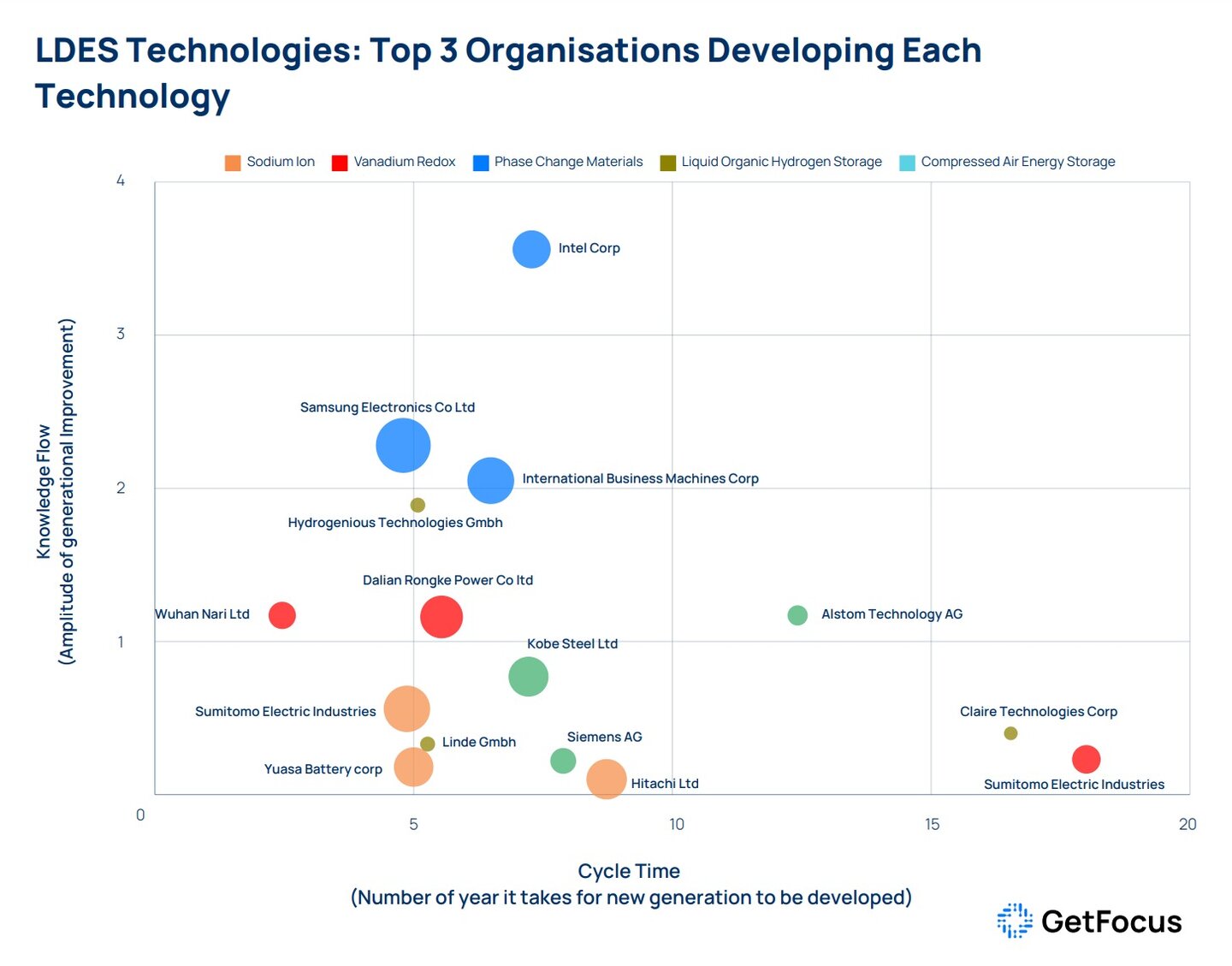

Using a quantitative method inspired by research from the Massachusetts Institute of Technology, GetFocus can estimate how rapidly any area of technology is improving, and if and when it will disrupt its market. Using global patent data, the system is able calculate a technology’s ‘cycle time’ – how many years it takes for a technology to produce a new generation of itself – and its ‘knowledge flow’ – how significant of a step forward a new generation represents. Using those metrics, GetFocus calculates the ‘technology improvement rate’, which represents the average percentage increase in performance per dollar that can be expected from an area of technology in one year.

“Essentially, we are able to measure how hard a problem is to solve,” says Kacper Gorski, GetFocus’ head of operations.

A versatile option across the energy grid

Sodium battery technology is experiencing similar improvements in areas such as energy density as lithium-ion (Li-ion) batteries did two decades ago. The associated cost reductions will mean the emergent technology is set to become a competitive solution for LDES by 2028 at the latest, finds the research.

Analysing 30 LDES technologies, the research found sodium-ion batteries to hold the most promise due to their fast improvement rate – around 57% in 2024. They offer more efficiency in round-trip energy use, greater operational flexibility and lose less energy during storage and supply. Their rapid improvement rate will likely lead to better energy density and reduce the cost per unit of stored energy, positioning them as a versatile option across the energy grid, even in large-scale operations, states the report.

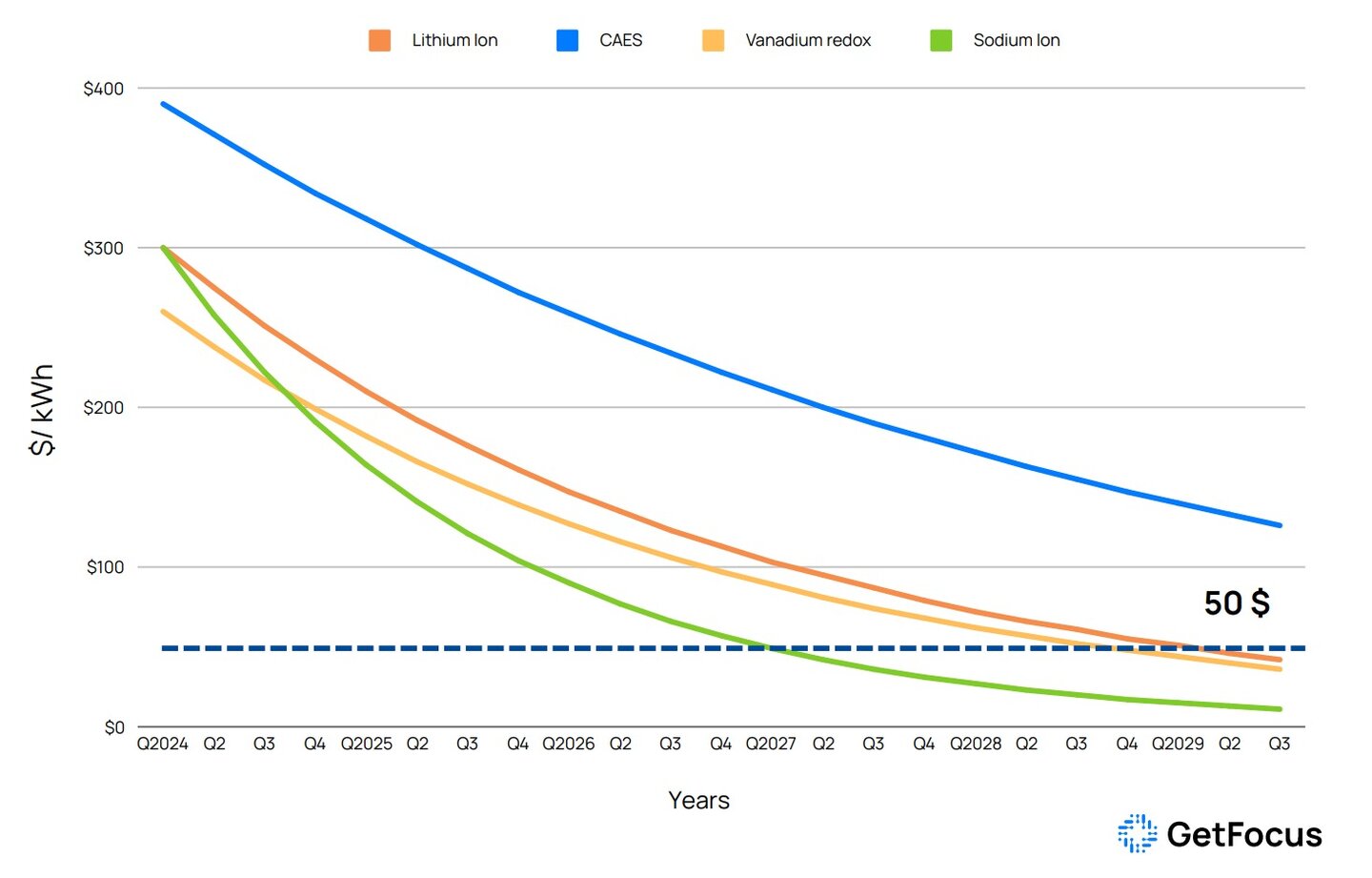

The average cost for sodium-ion cells in 2024 is $87 per kilowatt-hour (kWh), marginally cheaper than lithium-ion cells at $89/kWh. Assuming a similar capex cost to Li-ion-based battery energy storage systems (BESS) at $300/kWh, sodium-ion batteries’ 57% improvement rate will see them increasingly more affordable than Li-ion cells, reaching around $10/kWh by 2028.

According to GetFocus, achieving a cost of around $50/kWh is essential for BESS to be economically viable for grid-scale LDES in renewable energy applications. “That is the point when energy storage matches the cost of using dispatchable power sources like gas-fired power plants,” explains Gorski.

Indeed, in comparison with other forms of LDES, batteries are the best way to store energy, according to Gorski. “You can develop a new generation of batteries incredibly quickly in comparison to something like compressed air energy storage (CAES) – with all that infrastructure,” he says. “You can tweak the chemistry pretty quickly, and you can do it on a small scale and be fairly confident that you will be able to ramp it up to whatever storage requirement you need.

“But it is a bit ‘horses for courses’ with LDES,” he caveats. “There might be some other solutions like the phase change or CAES that are more attractive in certain locations.”

Sumitomo Electric Industries, Hitachi and Yuasa Battery are leading the development of sodium-ion battery technologies, states the report. Although the companies are yet to commercialise their technologies, Chinese battery company Great Power last year announced a 50MW/100 megawatt-hour LDES project to power a data centre, demonstrating that sodium-ion batteries are already under consideration for LDES.

“China will probably lead the way for sodium-ion battery production,” adds Gorski. “Europe and the US don’t have the appetite for the dangers of battery production.” In June, a fire at a lithium battery plant in South Korea killed 22 people and injured eight.

Power to the people

However, the supremacy of sodium-ion technology is still far from guaranteed. Manufacturers still have work to do to improve its energy density and round-trip efficiency, with ongoing developments also aimed at increasing the batteries’ longevity and life cycle performance.

“There are also unknowns around the production,” adds Gorski. “We are assuming you can turn a lithium-ion battery production facility into a sodium-ion battery production facility without too many issues.”

However, much of the technology’s fate lies in the hands of policymakers, with many eyes on China and the US as to how they incentivise the production. Gorski predicts LDES will be boosted if the Democrats wins a second term in the upcoming US election, with speeding up the energy transition a key priority for the administration.

“If we are going to take this transition seriously, we will need an awful lot of megawatts to be stored reliably. In Europe, we need to store this energy for nine months. The cost drop we are forecasting for sodium-ion would make it very attractive for that purpose,” says Gorski.

Overall, sodium-ion batteries’ compact footprint and cost-effective integration with renewable sources will position them as the dominant LDES technology for a variety of applications. Their versatility, applicability for both front-of-the-meter such as near wind or solar farms and behind-the-meter, has them poised to revolutionise the LDES market in the coming years, found the researchers.

However, the technology may have another superpower up its sleeve. Gorski believes it holds the potential to truly democratise power in the future. Eventually, households will be able to link the solar panels on their roofs with sodium-ion batteries in their garages or gardens to become truly energy self-sufficient.

“If we are able to package it up in a way that makes sense for the average consumer, suddenly they can be less reliant on the geopolitical or energy-price swings. The future is very bright – that could happen in less than a decade.”